The 15-Second Trick For Bank Draft Meaning

Wiki Article

Fascination About Bank Reconciliation

Table of ContentsThe Main Principles Of Bank Definition Examine This Report about Bank AccountHow Bank Draft Meaning can Save You Time, Stress, and Money.The Single Strategy To Use For Bank

You can also save your money and earn passion on your investment. The cash kept in most checking account is federally insured by the Federal Down Payment Insurance Coverage Corporation (FDIC), approximately a limit of $250,000 for specific depositors and $500,000 for collectively held deposits. Banks additionally supply credit score opportunities for individuals and companies.

Financial institutions earn a profit by charging even more interest to borrowers than they pay on interest-bearing accounts. A financial institution's size is established by where it is located and also who it servesfrom tiny, community-based establishments to large commercial banks. According to the FDIC, there were simply over 4,200 FDIC-insured business banks in the United States since 2021.

Though traditional banks use both a brick-and-mortar area and an on the internet visibility, a brand-new trend in online-only banks emerged in the early 2010s. These banks usually supply consumers greater rates of interest as well as reduced costs. Ease, rate of interest, as well as charges are a few of the variables that aid customers choose their preferred banks.

Bank Account Fundamentals Explained

banks came under extreme scrutiny after the global monetary crisis of 2008. The governing atmosphere for financial institutions has actually considering that tightened substantially therefore. United state banks are managed at a state or nationwide degree. Depending upon the structure, they may be managed at both levels. State financial institutions are regulated by a state's division of banking or division of economic establishments.

You need to think about whether you wish to keep both business as well as personal accounts at the exact same bank, or whether you want them at different financial institutions. A retail bank, which has standard banking services for consumers, is the most proper for everyday banking. You can pick a standard financial institution, which has a physical building, or an on the internet financial institution if you don't desire or require to physically check out a bank branch.

, for instance, takes down payments as well as provides locally, which might offer a more customized banking relationship. Select a practical location if you are choosing a bank with a brick-and-mortar area.

Some Known Incorrect Statements About Banking

Some banks also provide smart device apps, which can be helpful. Some huge banks are moving to finish overdraft account costs in 2022, so that can be a crucial factor to consider.Financing & Advancement, March 2012, Vol (bank draft meaning). 49, No. 1 Institutions that redirected here pair up savers and debtors aid make sure that economic situations operate efficiently YOU have actually obtained $1,000 you don't require for, claim, a year and also intend to make earnings from the cash until after that. Or you desire to get a house and also require to borrow $100,000 as well as pay it back over 30 years.

That's where financial institutions are available in. Although banks do lots of things, their key role is to absorb fundscalled depositsfrom those with money, pool them, and also lend them to those that require funds. Banks are intermediaries between depositors (who offer cash to the bank) and borrowers (to whom the bank lends money).

Depositors can be individuals and also families, economic and nonfinancial companies, or national as well as city governments. Customers are, well, the same. Down payments can be offered on demand (a bank account, for instance) or with some limitations (such as financial savings as well as time deposits). While at any kind of given minute some depositors need their money, many do not.

Some Known Details About Bank Draft Meaning

The procedure entails maturation transformationconverting short-term obligations (down payments) to long-term assets (car loans). Financial institutions pay depositors much less than they obtain from borrowers, as well as that distinction accounts for the bulk of banks' earnings in the majority of nations. Financial institutions can match conventional deposits as a source of financing by directly borrowing in the money as well as funding markets.

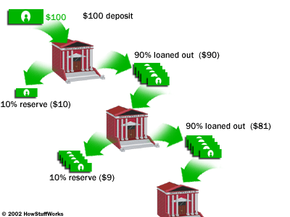

Banks maintain those needed gets on deposit with central financial institutions, such as the United State Federal Get, the Bank of Japan, and the European Central Bank. Financial institutions develop cash when they lend the rest of the money depositors bank exam books give them. This money can be utilized to buy products as well as solutions as well as can discover its means back into the financial system as a deposit in another financial institution, which then can provide a portion of it.

The dimension of the multiplierthe quantity of cash developed from a first depositdepends on the quantity of cash financial institutions have to keep get (bank certificate). Financial institutions also bank account number union bank offer and reuse excess cash within the economic system as well as produce, distribute, and profession securities. Banks have numerous methods of generating income besides taking the distinction (or spread) between the interest they pay on down payments and also borrowed money and also the passion they collect from consumers or safeties they hold.

Report this wiki page